How can we help institutional investors discover and evaluate all of their options?

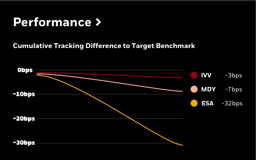

Beta strategy investors pick an index and an investment instrument that tracks it’s returns as closely as possible. What if they could explore the complete universe of instruments to find the best performance with the lowest cost with the lowest amount of risk?

I sat down with beta strategy institutional investors and mapped out their whole process, identified pain points and opportunities. I presented concepts, refined them until we landed on a solution. From there I worked in agile sprints to design, validate, and iterate in fast two week cycles.

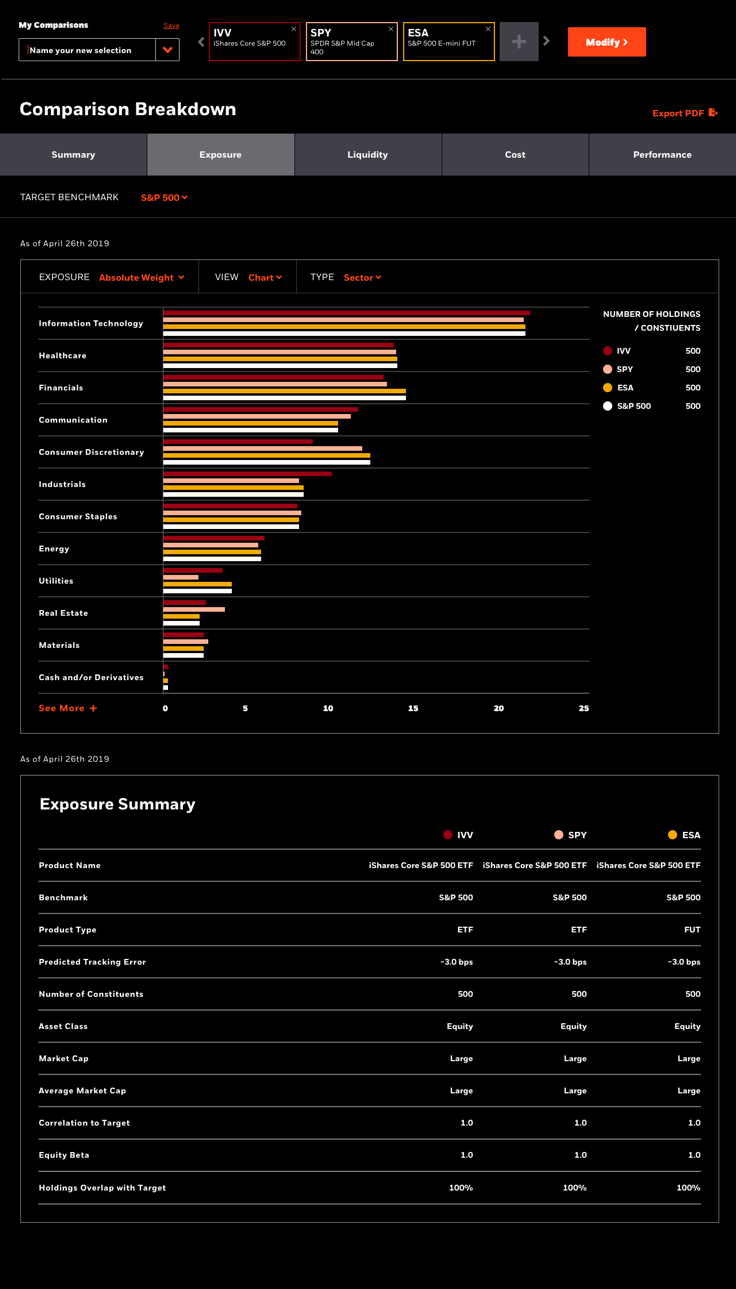

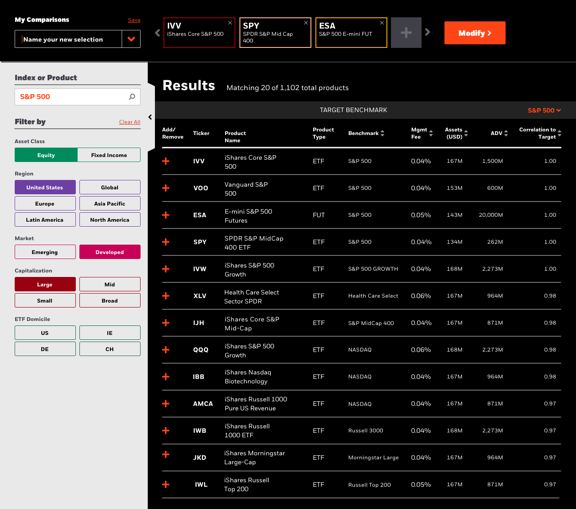

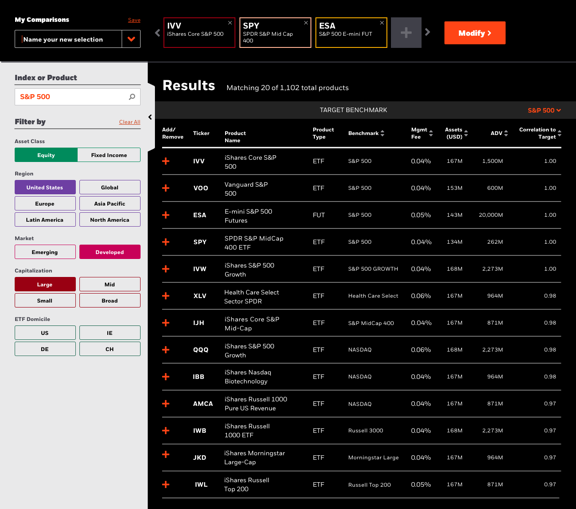

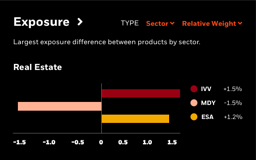

Users can narrow their field of view by selecting a target index or filtering by exposure. Afterwards they can add their top instruments to compare.

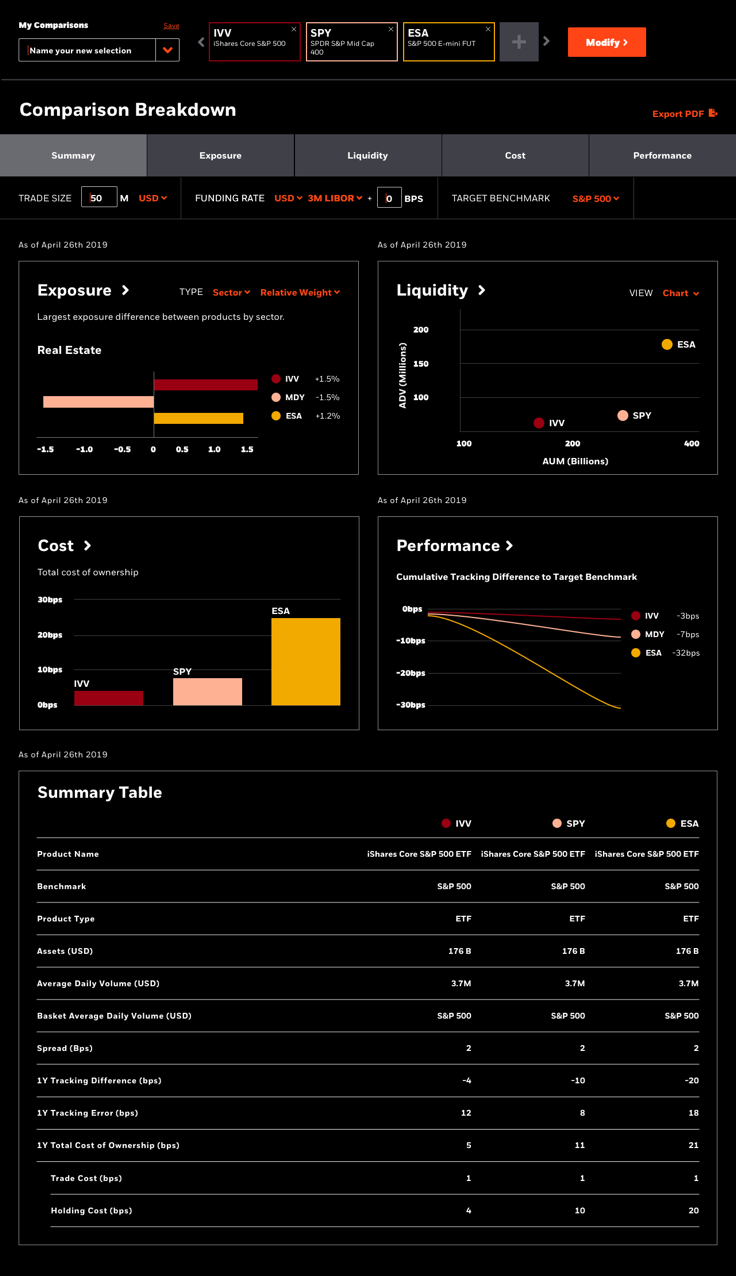

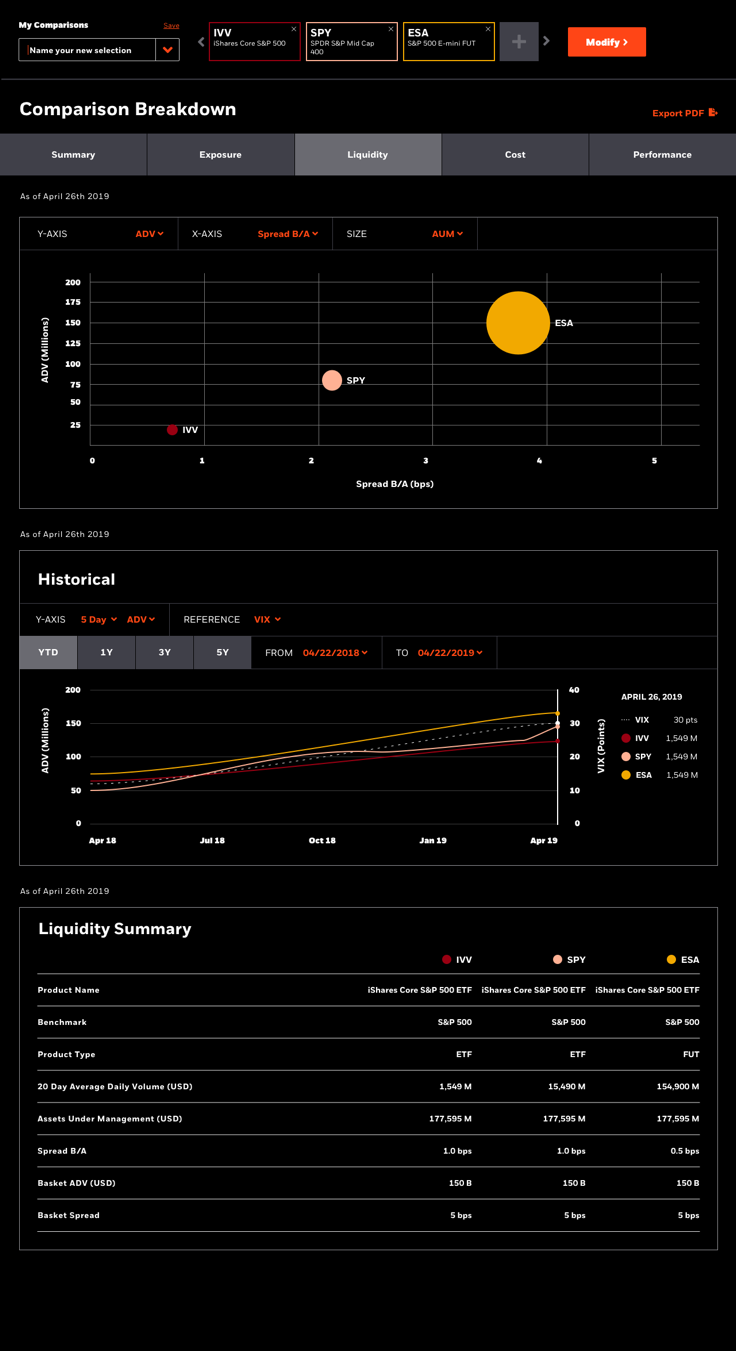

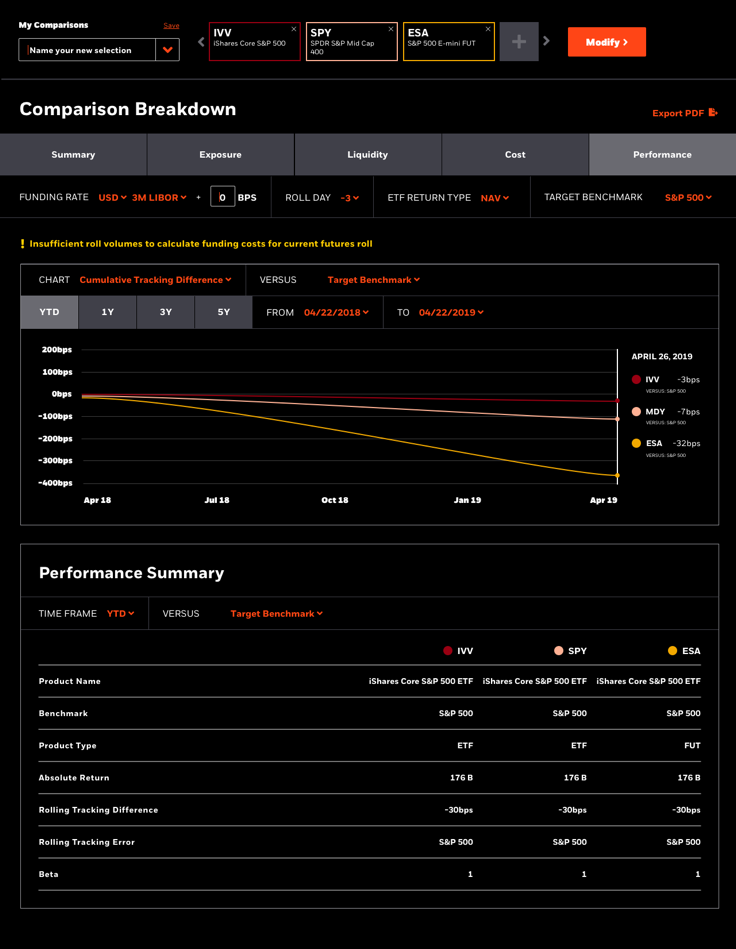

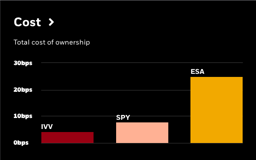

ETFs and Futures are hard to compare for a reason. Many of their metrics aren’t one for one. Its important to use the right lenses to evaluate them. The result is a high level view that also works at ground level.

By consolidating the complete universe of investment vehicles into one tool I was able to provide a comprehensive comparison experience that simplifies the search and evalutation process.